In the first quarter of 2024, house prices in Spain have increased by approximately 7% in nearly all tourist areas. Quite significant, especially when compared to the average increase in Spain of 3.3%. This and more in the Analysis of the Real Estate Market Spain 2024 Q1.

General situation real estate market Spain in 2024 Q1

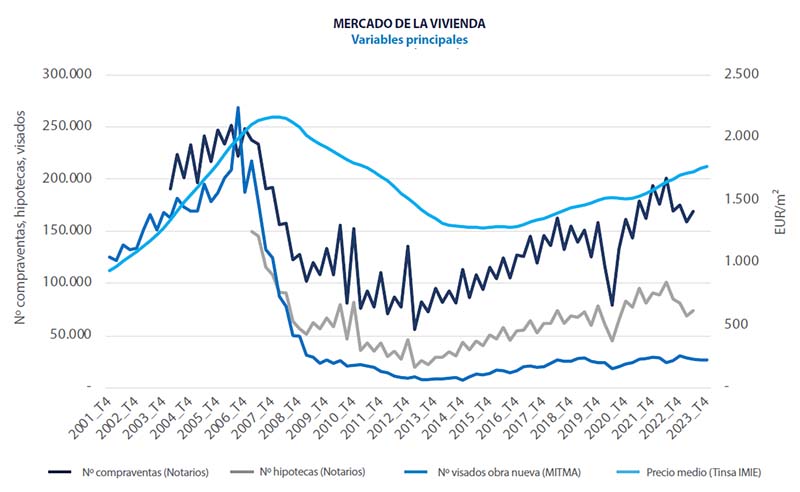

In the first quarter of 2024, house prices in Spain increased by 3.3% compared to the same quarter last year. In the fourth quarter of 2023, the increase was 4%, in the third quarter 5%, and in the second quarter of 2023, it was 4.9%. The increase appears to be stabilizing, but this is not the case across all of Spain.

Notably, municipalities known for tourism are experiencing less of the stabilizing trend. This mainly includes the Costas, islands, and major cities such as Valencia and Malaga. It is not the Spaniards but mainly foreigners buying houses in Spain who continue to keep this market lively.

Furthermore, price increases remain stable in areas with ample employment opportunities and their surrounding urban areas.

In the graph below, you can see the average value per square meter and the annual variation.

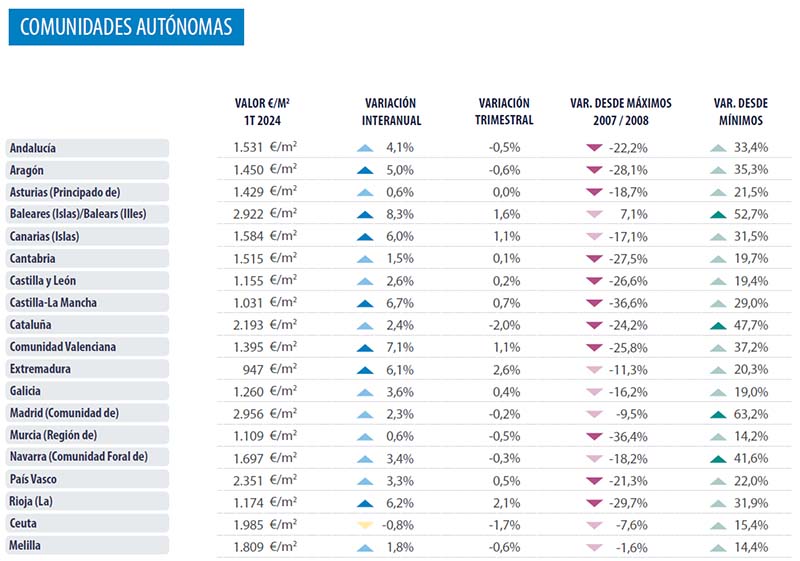

Property prices in Spain by autonomous region

Even the autonomous regions show that home prices are stabilizing. Annual growth is slowing down but remains moderately positive, and quarterly variations indicate a stable situation with little change. However, there are still notable regions, including the Balearic Islands, Valencia, and the Canary Islands, where prices are rising strongly both annually and quarterly.

On an annual basis, most regions show growth between 2 and 6%. The Balearic Islands (+8.3%) and Valencia (+7.1%) show the highest growth rates. However, Madrid (+2.3%) and Catalonia (+2.4%) show a clear slowdown.

In some autonomous regions, the provinces exhibit different behaviors, such as Andalusia (including the Costa del Sol) and Valencia. In Andalusia, Málaga, Almería, and Cádiz stand out. In Valencia, Alicante (which includes the Costa Blanca) and Valencia perform better than Castellón. Below, we delve further into the provinces.

Property prices in Spain by province

Remarkably, over the past year, prices have risen most significantly in Málaga (9.9%), followed by the Balearic Islands with 8.3%. Price increases in the provinces of Alicante (7.8%) and Valencia (7.2%) are also substantial.

Regarding quarterly variations, almost all provinces show little change, similar to the previous quarter. Málaga, however, shows a stronger increase of 3.2%.

In the province of Madrid, the annual variation is +2.3%, with a quarterly variation of -0.2%. In Barcelona, the annual variation is +2.6%, with a quarterly variation of -0.1%. Both provinces present similar figures for this quarter.

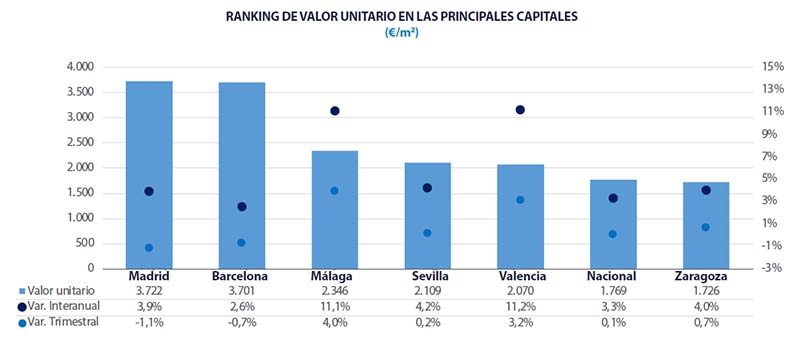

Real Estate Prices in the Major Cities of Spain

In the major cities, we observe a slight moderation, but some cities stand out due to sustained growth, especially Madrid and the coastal cities of Valencia, Almería, Santa Cruz de Tenerife, and Málaga.

Nearly all major cities show positive annual growth, mostly between 0% and 4%. Madrid grows by +3.9% and Barcelona by +2.6%, albeit at a slower pace than before. The cities of Valencia, Málaga, Santa Cruz de Tenerife, and Almería all show increases around 8%.

Quarterly figures indicate stability, with most cities showing growth between 0% and +1.5%, and 19 cities remaining virtually stable. The largest increases are seen in cities such as Girona and Málaga, with 4%.

Spain’s most expensive cities maintain their position, with Madrid and Barcelona among the top. Madrid (€3,722/m²) and Barcelona (€3,701/m²) are among the most expensive of the major cities. However, it’s worth taking ‘expensive’ with a grain of salt when compared to the current square meter price of London, which is £7,450/m² (€8,714/m²) or New York $15,252/m² (€14,203/m²). 😱

Conclusion real estate market Spain 2024 Q1

It seems that the housing market in Spain is currently fairly stable overall, after a period of strong growth. Prices are still rising, but not as rapidly as before. However, a major exception applies to areas of interest to foreign buyers, an interest that seems persistent.

It’s truly the regions known for their tourism sector that stand out in terms of growth. Buyers often have more purchasing power and are specifically looking for a second home, either as an investment or a vacation property for themselves. These areas are typically less affected by high inflation and interest rates. We also see stability in areas with more employment opportunities. Could this be because more people are emigrating to Spain?

Are you curious about which regions would suit you best, or where you could make a good investment? Feel free to get in touch or fill out a Property Finder Service form.

Source: Tinsa